English

Questions and answers

Questions and answers regarding funding under the Upgrading Training Assistance Act (AFBG) (Last updated August 2022)

1. What is funding under the Upgrading Training Assistance Act (AFBG)?

Funding under the Upgrading Training Assistance Act – or AFBG for short – is similar to funding for students under the Federal Training Assistance Act (BAföG) in so far as it represents a statutory payment tosupport people undergoing training. Funding under the AFBG differs from scholarship programmes which select grant recipients on a regular basis in so far as it can be claimed by anyone who satisfies the statutory requirements. From a political perspective, the AFBG aims to develop and expand upgrading training. Funding strengthens the motivation to undertake advanced training and improves career opportunities.

The AFBG addresses people taking part in measures leading to advanced vocational qualifications. Typical upgrading training measures are measures which lead to Meister and Fachwirt qualifications as well as courses at colleges of early childhood education or specialized technical colleges. In Germany, over 700 equivalent further training measures are eligible for funding under the AFBG.

Participants receive a contribution towards the cost of training irrespective of their income and assets. Participants in full-time measures also receive an additional means-tested payment to cover living expenses.

Funding is partly in the form of a grant and partly in the form of a low-interest loan from the KfW Development Bank.

Approximately 192,000 people received funding under the AFBG in 2019. This means that since its introduction in 1996, the AFBG has provided funding more than 10 billion euros to enable approximately 3 million people to undergo upgrading training and become senior management staff, entrepreneurs and instructors for the skilled labour of tomorrow.

2. What does the AFBG fund?

Funding is provided for full and part-time upgrading training measures offered by public and private providers which prepare participants for public upgrading training examinations under the Vocational Training Act (Berufsbildungsgesetz, BBiG) and the Crafts Code (Handwerksordnung, HwO) or for equivalent qualifications under federal or Länder law.

The professional qualification in question must be above the level of a skilled worker or journeyman examination or a vocational school-leaving certificate. This means that the successful completion of an initial training course is often the precondition for admission to the further training examination and thus for funding of a preparatory measure under the AFBG.

If the relevant public examination regulations so permit, funding under the AFBG can also be granted to participants in upgrading training who have previous qualifications other than having completed initial training (e.g. university dropouts or people with upper secondary leaving certificates and work experience). This is often the case with school-based further training in social professions (e.g. state-recognized early childhood teachers).

Until 31 July 2020, funding under the AFBG was provided for measures preparing participants for upgrading training. Due to the amendment of the AFBG, it will be possible from 1 August 2020 to claim funding for any upgrading training measure based on the BBiG and HwO and equivalent qualifications. Funding under the AFBG can therefore be provided for up to three upgrading training measures.

The three levels of upgrading training are:

- Certified specialist

- Bachelor Professional

- Master Professional

3. What are the minimum preconditions for eligibility for funding?

- A preparatory measure which is eligible for funding under the AFBG must prepare participants for a specific public examination in accordance with the Vocational Training Act (Berufsbildungsgesetz, BBiG), the Crafts Code (Handwerksordnung, HwO) or equivalent qualifications under federal and Länder law. As of 1 August 2020, funding can be claimed for training on each of the upgrading training levels set out in the BBiG and HwO and for equivalent qualifications.

- The measure, i.e. the course or school-based training, must comprise at least 400 class hours (minimum duration) and must be completed within a specific time frame and involve a specific frequency of classes. This means that funding is provided for attendance in classes. Pure self-learning is not eligible for funding under the AFBG. The amendment of 1 August 2020 introduces an extended concept of learning which includes virtual forms of teaching. “Physical and virtual face-to-face teaching” is eligible for funding. However, face-to-face teaching does not necessarily require the participant's physical presence in a specific location. “Virtual classrooms” can also meet the preconditions for face-to-face-teaching.

Further demands regarding full-time measures:

- As a rule, full-time measures consist of a minimum of 25 class hours per week on four working days (frequency of full-time upgrading training). With effect from 1 August 2016, block holiday weeks are deducted for full-time school-based measures lasting at least two years. Such measures are considered to have achieved the stipulated frequency of full-time upgrading training if this frequency is observed in 70 percent of the remaining weeks. This means that funding under the AFBG will take adequate account of external practical training which is often part of school-based training in the social professions.

- Full-time further training must not last longer than three years (maximum time frame for full-time training).

Further demands regarding part-time measures:

- Funding will be provided for part-time measures at the first level of upgrading training which comprise a minimum of 200 class hours.

- Part-time measures must consist of a minimum average of 18 class hours per month (frequency of part-time upgrading training).

- Part-time measures must not last longer than four years (maximum time frame for part-time training).

- Distance training courses can be funded as part-time measures provided that they satisfy the preconditions for funding under the AFBG and also meet the demands of the Distance Learning Protection Act (Fernunterrichtsschutzgesetz).

- Multi-media-supported courses are also eligible for funding if they are supplemented by periods of face-to-face teaching or comparable, binding media-supported communication periods of at least 400 hours and if they involve regular progress reviews.

- Only courses offered by certified providers with a corresponding quality assurance system are eligible for funding.

- Funding can also be provided for measures which link initial training with upgrading training provided that these measures are structured and recognized by the responsible examination body. The order of the examinations (initial training before further training) must be observed. However, trainees are not entitled to funding for living expenses under the AFBG during initial training as the employer is generally legally obliged to pay an appropriate training allowance.

4. Who is eligible for funding?

The AFBG provides funding for people taking part in measures that are eligible for funding and which prepare for further training qualifications as master craftspersons, industrial supervisors, early childhood teachers, technicians, commercial specialists, certified business economists or one of over 700 comparable qualifications.

There is no age limit for funding under the AFBG.

In order to qualify for funding, participants must fulfil the conditions of the respective further training regulations for admission to the examination or admission to the intended course at a trade and technical school (previous qualifications).

Participants with a bachelor’s degree or a comparable university degree are also entitled to funding provided that this is the highest higher education degree they have attained.

In addition to German citizens, non-Germans are also eligible for funding under the AFBG if they have assured prospects of remaining in Germany. Here the AFBG imposes the same demands as the Federal Training Assistance Act (BaföG). Certain residence permits entitle the individual to begin upgrading training funded under the AFBG immediately; others call for a certain minimum period of residence in Germany. Section 8 AFBG contains concrete provisions.

Participants in training measures who have already received funding under the AFBG in the past are generally not eligible for renewed funding. However, there are a number of exceptions to this rule. For example, a participant who has already received AFBG funding for a qualification may receive renewed funding if this qualification is a precondition for admission to the examination for which he or she is seeking renewed funding. This situation is similar to that of students who receive BAföG funding for a bachelor’s degree programme and subsequently for a master’s degree programme.

5. How is funding provided?

1. Funding for course and examination fees as well as for a Meister examination project

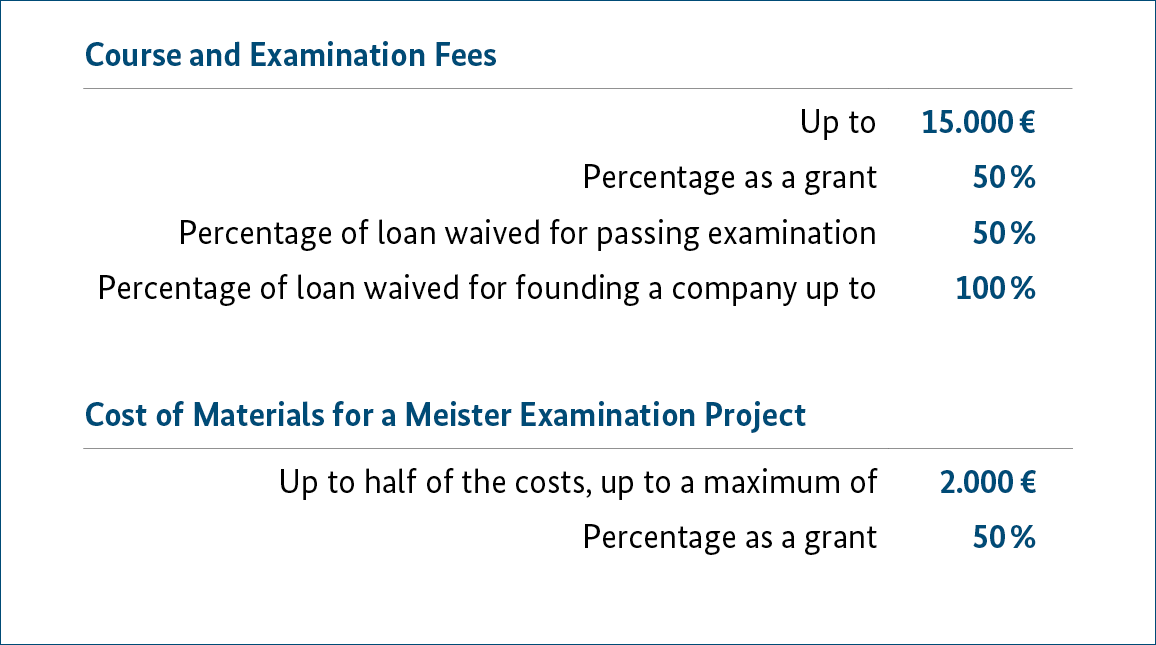

Irrespective of their income and assets, participants receive a sum equivalent to the level of actual fees up to a maximum of 15,000 euros in order to cover course and examination fees.

Participants receive 50 percent of the funding in the form of a non-repayable grant. Participants receive an offer from the KfW Development Bank for a low-interest bank loan for the remaining share of 50 percent. Participants are not obliged to take advantage of this offer.

In addition, upon passing the examination, participants may apply to have 50 percent of the loan to cover course and examination fees which is not yet due for repayment waived.

Participants who have received funding and set up a business can take advantage of a remission of 100 percent of the fees. This means that they do not have to repay the bank loan.

Funding of up to half of the necessary costs and up to a maximum of 2,000 euros can be granted towards the cost of materials for the Meister examination project. Here too, 50 percent of the funding is provided in the form of a grant. The KfW Development Bank offers a low-interest bank loan to cover the remaining 50 percent of the funding.

2. Special support for single parents

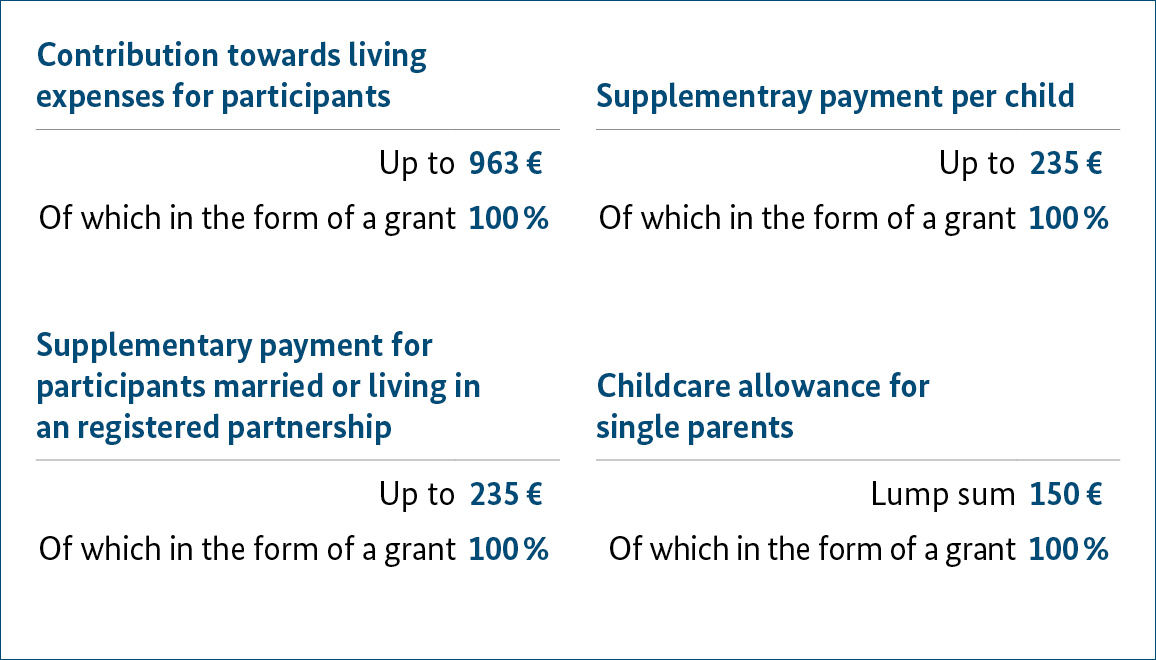

Single parents with children under 14 years of age or with children with disabilities living in their household are entitled to a lump sum childcare supplement of 150 euros irrespective of their income and assets. They receive this payment entirely in the form of a grant during the measure. This funding is provided irrespective of whether the training takes place on a full-time or part-time basis.

3. Funding of additional living expenses during full-time measures

People taking part in full-time measures can also receive a contribution towards the cost of living in addition to funding to cover training costs. This payment to cover living expenses depends on the individual’s income and assets as well as on the income of his or her spouse or life partner.

As of 1 August 2020, funding to cover living expenses is entirely paid in the form of a non-repayable grant.

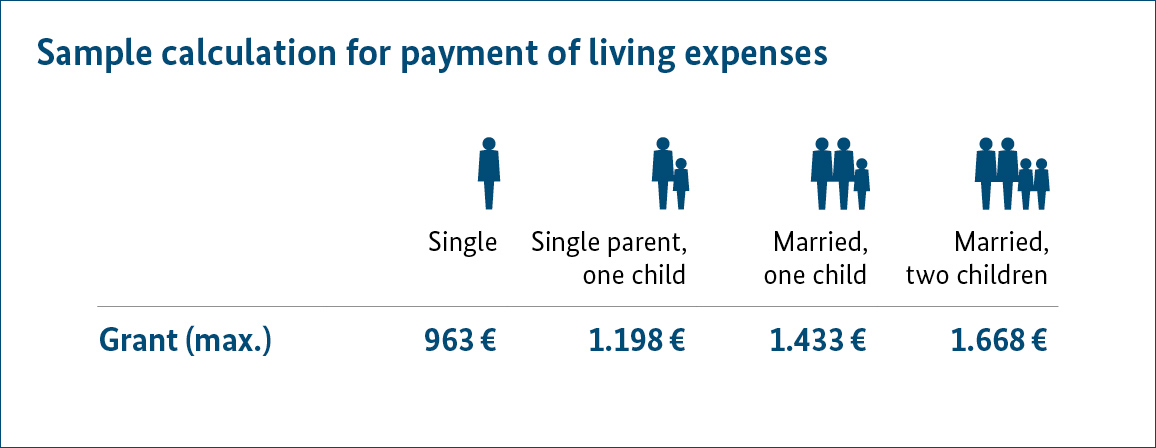

The maximum payment for single persons is 963 euros per month. The payment comprises an allowance to cover basic needs, accommodation, a supplementary payment and possible additional contributions towards health and long-term care insurance.

The maximum monthly payment is increased by 235 euros for married participants or participants in a registered partnership who are not permanently living apart.

The maximum monthly payment is increased by 235 euros for each child for whom the participant is entitled to claim child benefit.

The allowance for income from other sources amounts to 330 euros. The additional consideration of income-related expenses and a flat-rate deduction of compulsory social security contributions mean that participants are entitled to earn up to 450 euros from a “mini-job” without this affecting their entitlement to AFBG payments.

This allowable deduction is increased by 805 euros for people who are married or in a registered partnership and are not permanently living apart. It rises by 730 euros per child.

A married or registered partner has an additional own allowance of 1,605 euros before his or her income is offset against AFBG funding.

Financial assets of up to 45,000 euros are not offset. This allowable deduction is increased by 2,300 euros for people who are married or living in a registered partnership and are not permanently living apart. It also increases by 2,300 euros per child.

The assets of a spouse or registered partner are not taken into account. This also applies for appropriate self-used property and a car.

6. What factors must be taken into consideration when claiming the loan part of funding?

The KfW Development Bank issues the loan in accordance with the AFBG. Funding recipients receive an offer for the loan share of funding from the KfW following approval of their application by the responsible funding office. Participants have a certain period of time to decide whether to accept the offer. They can claim the entire loan or only part thereof.

The loan is low-interest and interest and repayment-free during the period of training and a subsequent period of grace of up to a maximum of six years.

Repayment takes place within ten years following this period. The monthly rate of repayment is at least 128 euros.

Should the loan recipient fall below a certain income threshold during the repayment phase he or she can be exempted from repayment for a period of up to five years. In addition, there are special provisions for the deferment and waiving of payments for people with low incomes and people caring for children under the age of 14 or for close relatives.

Important: Success pays off especially for people receiving loans!

1. Upon presentation of the examination certificate, anyone who has passed the further training examination will benefit from the waiver of 50 percent of the loan for course and examination fees which is not yet due for repayment.

2. Anyone who additionally establishes or takes over a company will have the entire loan for course and examination fees waived.

7. What must recipients do in return for funding?

Participants are obliged to take part in the training measure on a regular basis. Sitting or passing examinations are not preconditions for retaining funding.

Keeping track of regular attendance ensures that the tax money spent on funding is employed purposefully. Funding to cover living expenses is provided under the AFBG for full-time measures because for time reasons it is not possible for participants to regularly pursue a gainful occupation to secure their livelihood. In the case of part-time measures, keeping track of regular attendance ensures that state funding has not been provided in vain because the participant has failed to attend classes.

Nevertheless, funding must only be repaid if the participant has failed to attend more than 30 percent of the classes. This relatively generous provision regarding absenteeism allows for appropriate flexibility to meet the special demands of balancing training, family life and career.

Anyone who fails to attend even this minimum number of classes must normally repay the funding received – with the exception of statutory exemptions which prevent cases of hardship caused through no fault of one’s own (e.g. the sudden discontinuation or interruption of training due to illness). Recipients of funding must therefore pay particular attention to ensuring regular attendance.

The same applies to participants in distance learning and media-supported measures who must participate in regular performance assessment measures.

A form must be used to prove regular attendance. This is to be filled in by the provider of training and presented by the participant to the responsible funding office on two occasions (six months after the beginning and at the end of the measure).

8. Further questions and how to apply

Should you have further general questions regarding the AFBG, please contact the AFBG hotline or the competent funding office. A list of funding offices is available at:

www.aufstiegs-bafög.de/foerderaemter-und-beratung

The funding offices can also provide information regarding the eligibility of a specific measure, your personal prerequisites and funding details.

Comprehensive general information on upgrading training assistance under the AFBG is available on the AFBG website of the Federal Ministry of Education and Research (BMBF):

https://www.aufstiegs-bafoeg.de/de/english

You will find application forms to download. Applications must be sent to the competent funding office.

https://www.aufstiegs-bafög.de/antragsformulare

The website also provides an overview of the online application facilities in the Länder.